What You Need to Know (Without the Jargon!)

Let’s be real—nobody likes taxes. They take a chunk out of your paycheck, make your shopping bills higher, and somehow always seem to pop up when you least expect them. But, like it or not, taxes are a part of life. So, instead of dreading them, let’s break them down in a way that actually makes sense (and maybe even saves you some money!).

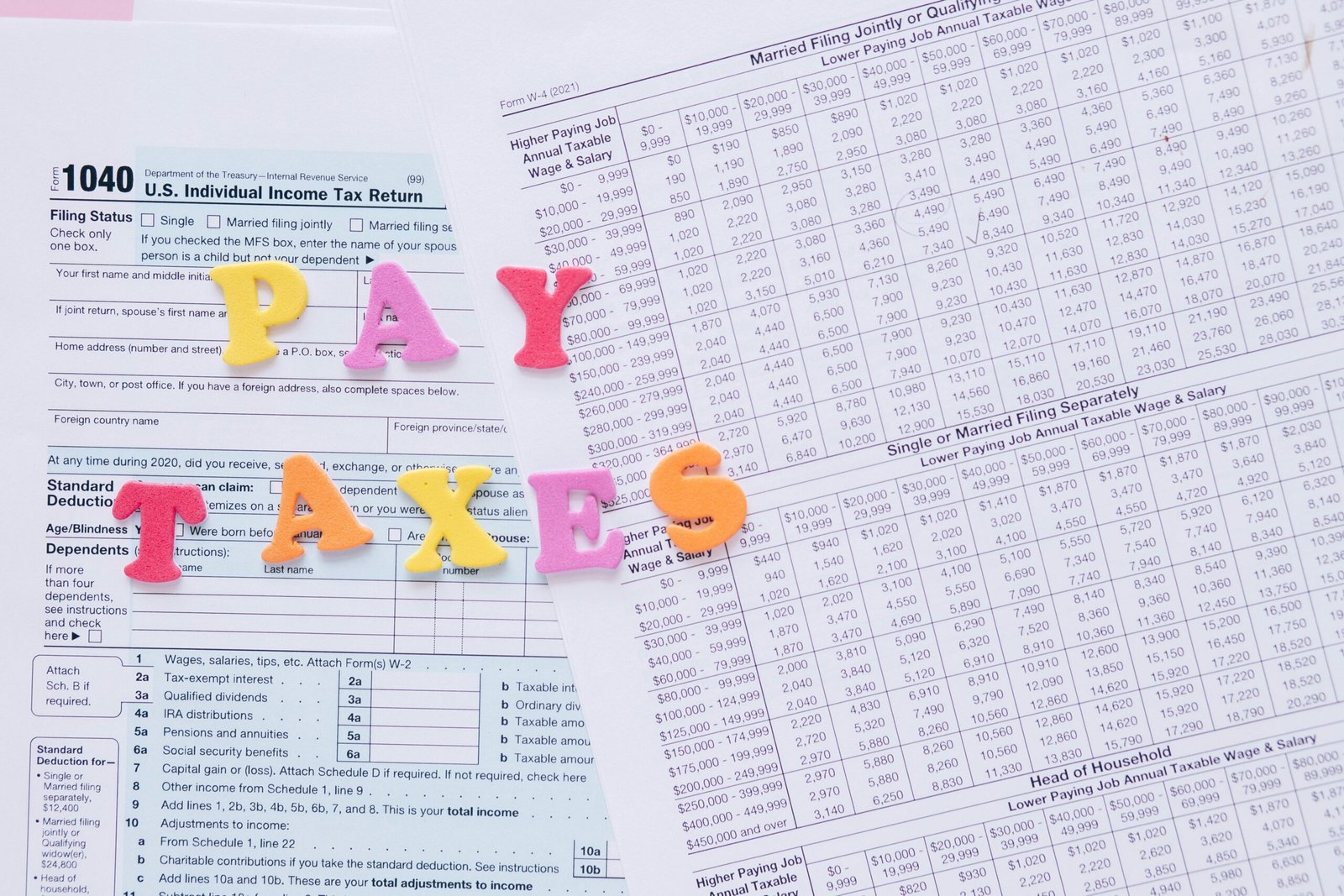

What Are Taxes, Really?

Taxes are basically how the government keeps the lights on. They fund everything from roads and schools to hospitals and emergency services. Every time you get paid, buy something, or own property, you contribute to keeping the country running. Sounds fair, right? Well… sometimes.

Types of Taxes You Deal With

Here are the most common taxes that hit your wallet:

- Income Tax – This is the big one. A percentage of your earnings goes straight to the government. The more you earn, the more you pay (unless you find smart ways to reduce it—more on that later!).

- Sales Tax – That extra charge on your bill when you shop? That’s sales tax. Some states or countries charge more than others, so keep an eye on it.

- Property Tax – Own a home? Congrats! Now, pay up. Property taxes help fund local schools, roads, and public services.

- Capital Gains Tax – Made a profit on stocks or real estate? The government wants a piece of that too.

- Corporate Tax – If you run a business, a portion of your company’s profits goes to taxes.

- Excise Tax – This sneaky tax applies to things like gasoline, alcohol, and cigarettes.

How to Pay Less in Taxes (Legally!)

Nobody wants to overpay on taxes. The good news?

✅ Take Advantage of Deductions – Things like student loan interest, medical expenses, and even home office costs can reduce your taxable income.

✅ Invest in Retirement Accounts – Contributions to 401(k)s or IRAs often come with tax benefits.

✅ Claim Tax Credits – These directly reduce the amount of tax you owe. Popular ones include the Child Tax Credit and Education Credits.

✅ Consider Tax-Friendly Investments – Municipal bonds, Roth IRAs, and other tax-efficient investments can help you keep more of your earnings.

✅ Hire a Tax Pro – Sometimes, an expert can save you more than their fee. They know all the loopholes and legal tricks to reduce your tax burden.

The Future of Taxes

Governments are always changing tax laws, so staying informed is key. With rising debt, increasing global trade, and the growth of digital assets like cryptocurrency, tax policies will continue to evolve. If you’re investing or planning for the future, keep an eye on tax law updates.

Final Thoughts

Taxes might not be fun, but they don’t have to be painful either. The more you understand them, the more control you have over your finances. So, instead of avoiding tax talk, embrace it—your wallet will thank you!

Comment if any question

Leave a Reply