The financial landscape is constantly evolving, and staying ahead of market trends is crucial for investors, businesses, and analysts. As we navigate through 2024, several key trends are shaping the global economy, stock markets, and cryptocurrency sectors. This article provides an in-depth analysis of market trends and insights to help you make informed decisions.

1. Global Economic Outlook

The world economy is experiencing a shift, influenced by inflation rates, interest rate changes, and geopolitical tensions. Major economies like the U.S., China, and the EU are adjusting their monetary policies to combat inflation while fostering economic growth.

- Interest Rates: The Federal Reserve’s approach to interest rates remains a key driver in stock and bond markets.

- Inflation Trends: While inflation is gradually stabilizing, energy and commodity prices still play a critical role.

- Geopolitical Factors: Trade relations and supply chain disruptions continue to impact global financial markets.

2. Stock Market Trends

Tech Sector Dominance

The technology sector continues to lead the market, with AI-driven stocks, cloud computing, and semiconductor industries driving growth. Companies investing in artificial intelligence, such as Nvidia and Microsoft, are outperforming the market.

Green Energy Investments

Renewable energy and sustainable investments are gaining traction. Governments worldwide are pushing for green initiatives, making clean energy stocks a hot investment option.

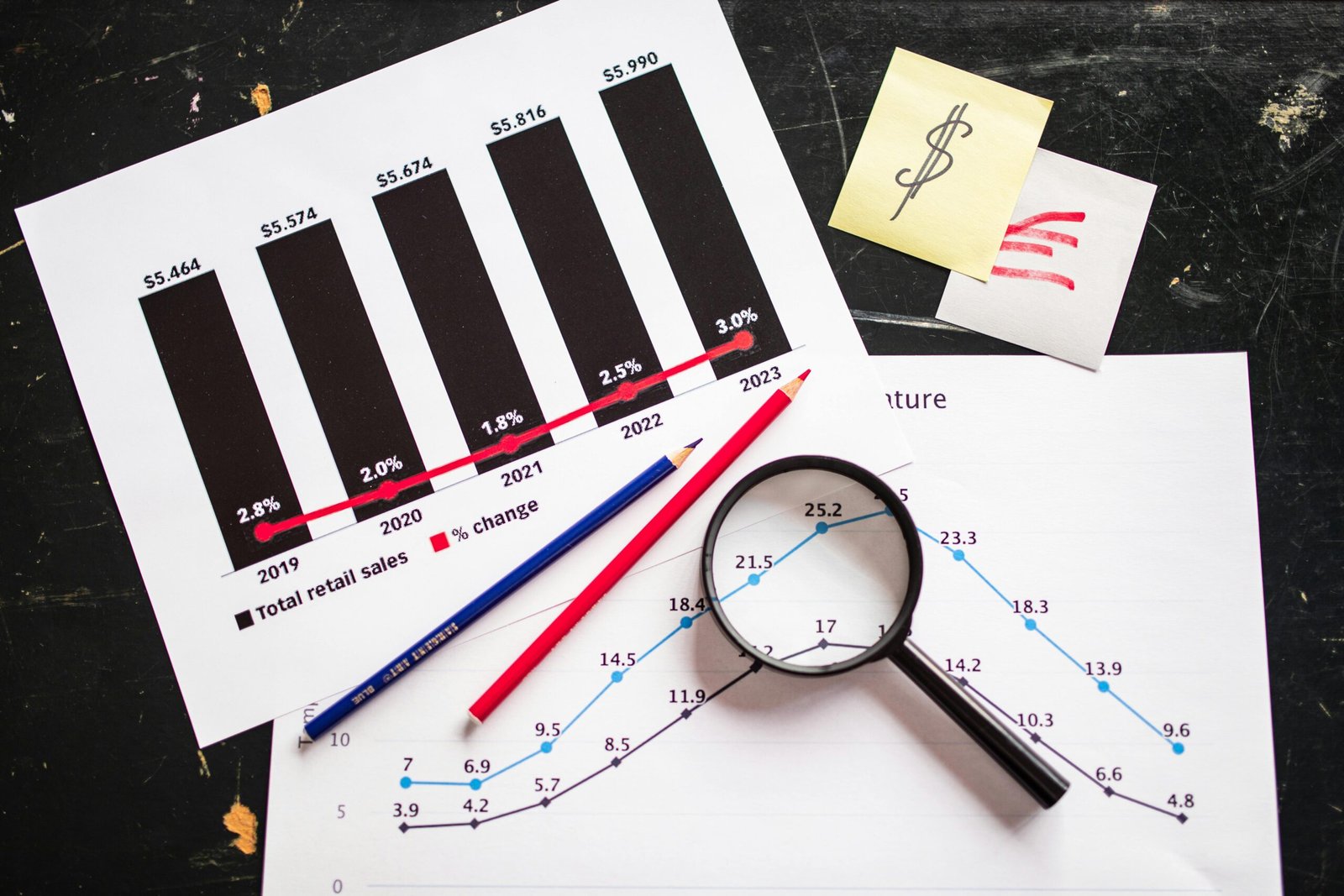

Consumer and Retail Sector Shifts

Consumer behavior is shifting towards e-commerce and digital services, influencing major retail and fintech companies.

3. Cryptocurrency Market Analysis

Bitcoin and Ethereum Trends

- Bitcoin (BTC): Bitcoin has surpassed $100,000 in 2024, driven by institutional adoption and ETF approvals.

- Ethereum (ETH): The transition to Ethereum 2.0 is improving transaction efficiency and scalability, attracting more developers.

Memecoins and Altcoins

Shiba Inu (SHIB) and Dogecoin (DOGE) continue to experience volatility but maintain strong community support. Meanwhile, emerging altcoins with real-world applications are gaining investor interest.

Regulatory Developments

Governments worldwide are tightening regulations around cryptocurrencies, emphasizing security, anti-money laundering measures, and investor protection.

4. Future Predictions and Strategies

- Diversification: Investors should focus on diversified portfolios to mitigate risks in volatile markets.

- Tech and AI Investments: AI and blockchain technologies are likely to drive long-term growth.

- Market Adaptability: Keeping an eye on economic policies and adapting investment strategies accordingly will be crucial.

Conclusion

Market trends in 2024 reflect rapid technological advancements, evolving economic policies, and shifts in investor sentiment. Staying informed and making data-driven decisions will be key to capitalizing on these trends. For more updates on market trends and investment strategies, subscribe to our newsletter.

Leave a Reply